The Freedom From Religion Foundation is decrying the diversion of billions of taxpayer dollars to private, mostly religious schools in the recently passed $1.9 trillion COVID relief package.

When private school mogul Betsy DeVos was at the helm of the Department of Education, it was no surprise that the federal government used the pandemic to funnel taxpayer money into the coffers of private religious schools, a practice FFRF condemned at the time. Alarmingly, the new Congress has continued this practice by including $2.75 billion that will go to private schools under the Trump-era “Emergency Assistance to Non-Public Schools Program.” This provision was added by the U.S. Senate.

These funds are part of $4 billion that the federal government will allow governors to distribute at their discretion. This sort of discretionary scheme is what led South Carolina Gov. Henry McMaster to try to give $32 million to private schools in the state. Fortunately, the state Supreme Court unanimously concluded that this religious giveaway violated the South Carolina Constitution.

Taxpayers should not be forced to fund religious education. The vast majority of private schools are religiously affiliated, and vouchers and tuition tax credits almost entirely benefit religious schools with overtly religious, mostly Christian missions, which integrate religion into every subject. For instance, in Wisconsin, Indiana and North Carolina, between 90 to 100 percent of schools participating in each state’s voucher or neovoucher program are religious.

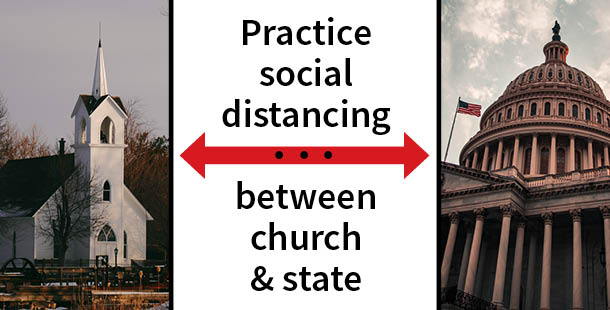

When the authors of the U.S. Constitution included a groundbreaking separation between religion and government, religious funding was an explicit concern on their minds. In his Memorial and Remonstrance on Religious Assessments, James Madison, the Father of the Bill of Rights and the Constitution, explained this principle in his condemnation of a three-penny tax to support Christian preachers and churches: “The religion then of every man must be left to the conviction and conscience of every man,” not to the taxing power of the government.

Where public money goes, public accountability should follow. But private religious schools qualifying for funding under the program provide no such accountability. When taxpayers pay a $2.75 billion bill, they are entitled to transparent accountability in how those funds are used. The lack of oversight of private schools eligible for public funding encourages widespread fraud and mismanagement. The voucher program in Milwaukee, which is the longest running in the country, stands as a prime example. More than $139 million in tax money over a 10-year period has gone to Milwaukee voucher schools that were eventually removed from the program for failure to meet basic requirements.

The funding of private schools hurts public schools, particularly disenfranchising rural students, FFRF points out. For millions of parents who live in rural communities, there are no nearby private schools for them to send their children. The latest round of COVID relief funds diverts $2.75 billion of education funding from underfunded public schools to private schools predominantly in urban areas.

All families are welcome in public schools. The new funding places $2.75 billion into the Trump-era “Emergency Assistance to Non-Public Schools Program,” which allows private, mostly religiously segregated schools to participate so long as they do not discriminate on the basis of “race, color, or national origin.” But that still allows schools receiving taxpayer funds to openly discriminate on the basis of sex, sexual orientation, gender identity, disability or religion. Public funds should never be used to support such discrimination. “Even in the midst of a pandemic, our . . . Constitution remains a constant, and the current circumstances cannot dictate our decision,” as the South Carolina Supreme Court pointed out in ruling unconstitutional the diversion of millions of Covid relief dollars from public to private schools last year. No matter the circumstances, the Constitution must be followed. Politicians must not be allowed to use emergency circumstances to force taxpayers to fund religion.

FFRF calls on all members of Congress to ensure that this boondoggle is not repeated in the future, and that public funds support only public schools.

Read FFRF’s brochure, The Case Against Vouchers & Tuition Tax Credits.