The Freedom From Religion Foundation condemns the unconstitutional, possibly corrupt handout of taxpayer funds to churches, including churches run by some of President Trump’s closest allies, under the Paycheck Protection Program. New data released by the Small Business Administration on the program’s forgivable loans shows that more than 12,400 American churches took in billions of taxpayer dollars (while some were helping to spread the pandemic).

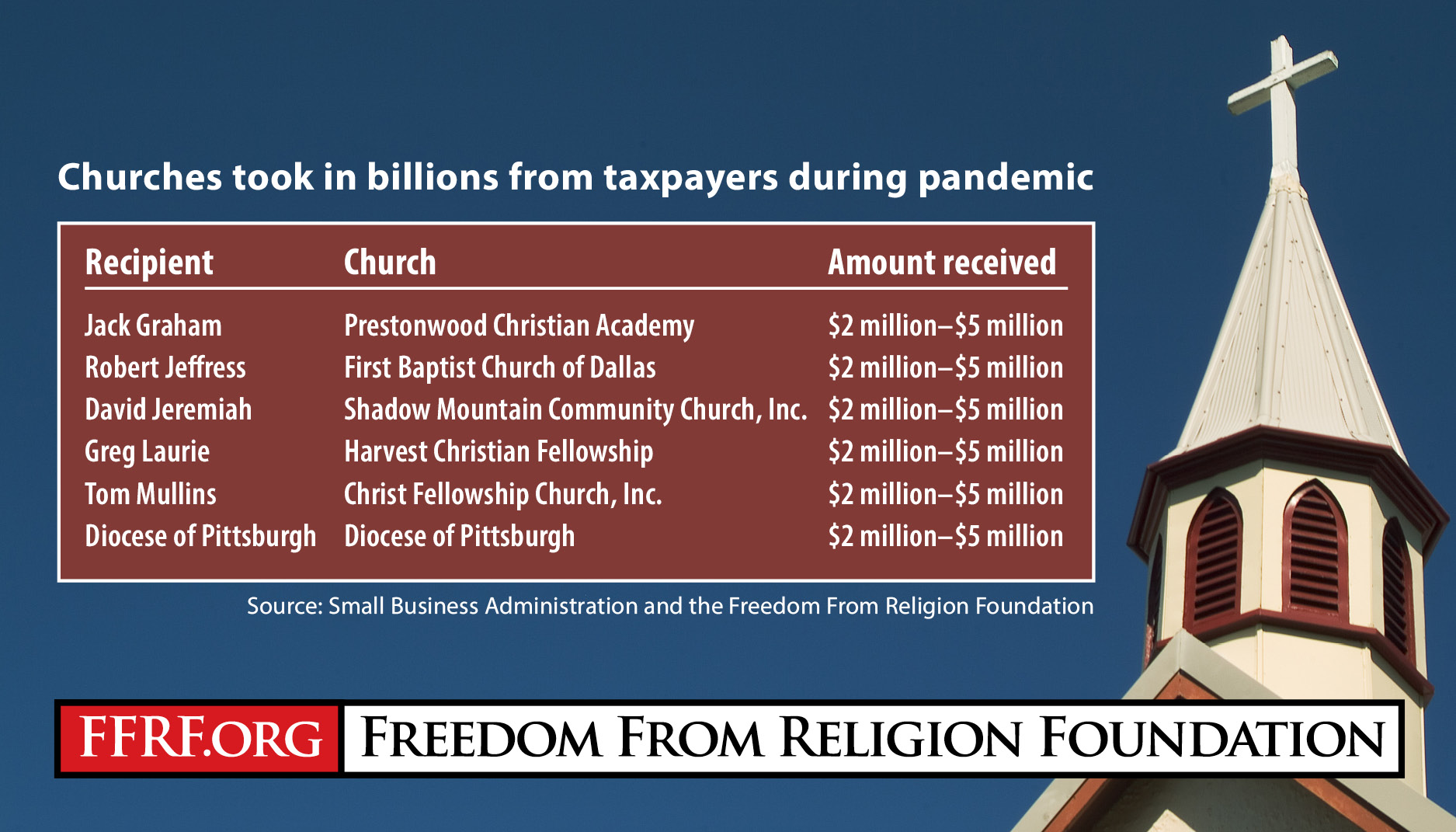

Trump’s Evangelical Advisory Board reaped substantial benefits. The First Baptist Church, run by Robert Jeffress, a vocal supporter of Trump’s Christian Nationalist policies, took in between $2 million and $5 million. Other members of the board fed at the government trough, many also receiving $2 million–$5 million, including: Jack Graham (Prestonwood Christian Academy); David Jeremiah (Shadow Mountain Community Church); Greg Laurie (Harvest Christian Fellowship), and Tom Mullins (Christ Fellowship Church). Still others connected to the board obtained smaller amounts, such as Paula White (City of Destiny), whose church received at least $150,000.

And yet other churches closely aligned with Trump also got forgivable loans of $2 million or more, including King Jesus International Ministry in Miami, led by Trump ally Guillermo Maldonado. It is difficult to determine with specificity how much taxpayers were forced to give to church leaders personally connected to Trump, but the figure is at least close to $50 million.

FFRF analysis, made possible by an initial search through the data for houses of worship (conducted by Professor Ryan Burge and posted publicly) reveals that U.S. churches took in at least $6 billion of taxpayer funds, possibly much more, in the Paycheck Protection Program. FFRF sounded the alarm in May about precisely this problem with the program’s funding, and has been vigorously investigating it ever since.

“These numbers are staggering,” says FFRF Co-President Annie Laurie Gaylor. “It’s everything the framers of our godless Constitution dreaded: the government wielding its taxing power to force citizens to support churches and pay preachers’ salaries. Where public money goes, public accountability should follow, but that is not the case with church finances.”

“One of the real dangers with unconstitutionally sending taxpayer funds to churches is that they become beholden to politicians,” adds FFRF Co-President Dan Barker. “This was one of the harms our Founders worried about.”

Roman Catholic churches and dioceses also dominated the list of recipients. For instance, the Diocese of Pittsburgh took in between $2 million and $5 million. That diocese was infamously featured in the Pennsylvania grand jury report on abuse and rape of minors involving 90-plus priests, some of whom marked victims with gold cross necklaces so other priests could more easily spot them. The church received its taxpayer infusion 20 months (to the day) after the grand jury report was finalized.

The Small Business Administration loan numbers were not specific, but were released in five sets of ranges: $150,000–$300,000; $350,000–$1 million; $1 million–$2 million; $2 million–$5 million; $5 million–$10 million.

The many reports and news stories about churches and worshippers acting as superspreaders of the coronavirus, with a number of them suing the government for preferential treatment from stay-at-home orders, make this gross violation of the principle of separation between state and church all the more appalling. As FFRF has documented, scientific data shows that churches have often been responsible for spreading the virus.

FFRF intends to continue its investigation into this constitutional violation and the appearance of political cronyism. This is just the tip of an unconstitutional iceberg.

Note: As a qualifying secular 501(c)(3) nonprofit, FFRF was eligible for and received a forgivable loan under the Paycheck Protection Program of less than half a million dollars. Unlike churches, FFRF discloses its finances to the government and the public by filing an annual Form 990 information return. Churches, which receive automatic tax exemption, are uniquely exempted by the Internal Revenue Service from filing financial disclosures, making them unaccountable black holes.