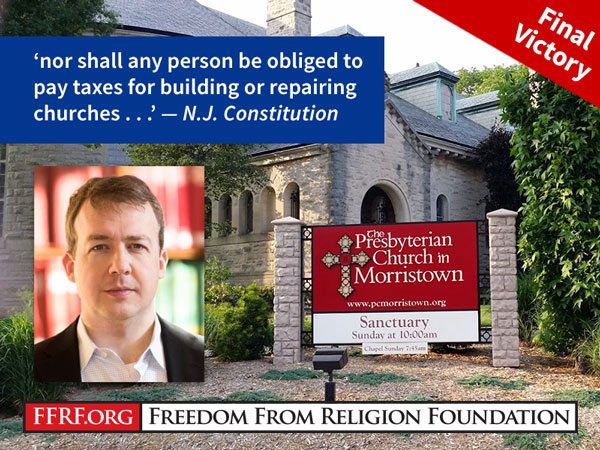

The U.S. Supreme Court today let stand a huge win for Freedom From Religion Foundation — and state/church separation — in a case about unconstitutional governmental funding of churches in New Jersey.

The N.J. Supreme Court had unanimously held last April that taxpayers in Morris County could not be forced to pay to repair active houses of worship, several of which explicitly sought tax money in order to advance their religious mission. Morris County, defended by the Catholic Becket Fund, had asked the U.S. Supreme Court to take its appeal of FFRF’s resounding victory. The Supreme Court on Monday, March 4, denied Morris County’s petition.

Morris County had requested the Supreme Court extend a 2017 case, Trinity Lutheran v. Comer, which held that Missouri could not exclude a church-owned playground from a secular funding program.

Six of the justices declined to review the case without comment. Justices Brett Kavanaugh, Samuel Alito and Neil Gorsuch offered two of their own reasons for the denial, both of which mischaracterized the case. First, they stated that the court’s refusal to hear the case was appropriate because “the factual details of the Morris County program are not entirely clear.” However, the facts of this case are actually clear and have never been in dispute.

Second, the three justices asserted that the law still needs development on the question of “whether governments may exclude religious organizations from general historic preservation grants programs.” This twists the facts of the case, which involves the right of taxpayers not to be forced to fund active houses of worship. The New Jersey Supreme Court’s decision did not require discrimination against religious organizations. In fact, Morris County provides funds to church-owned secular historic buildings — and even to historic churches that are not in use as houses of worship. Such funding was neither challenged by FFRF nor prohibited by the New Jersey Supreme Court.

The U.S. Supreme Court decision will save New Jersey taxpayers many millions of dollars and protects the religious liberty of all New Jersey residents.

“This is a big triumph for the rights of hardworking New Jersey folks,” comments FFRF Co-President Dan Barker. “The Supreme Court made the right call in refusing to jettison the basic tenets of our Constitution.”

Morris County churches argued that they are entitled to taxpayer funds, even though the state Constitution specifically forbids such religious use of tax money. At the heart of the lawsuit is the New Jersey Constitution’s guarantee: “nor shall any person be obliged to pay tithes, taxes, or other rates for building or repairing any church or churches, place or places of worship, or for the maintenance of any minister or ministry, contrary to what he believes to be right.” (Article I, Paragraph 3) This taxpayer protection predates the creation of the United States and is a principle that the Founders, including Thomas Jefferson, saw as an essential guarantee to prevent the government from forcing citizens to support religions in which they disbelieve.

The plaintiffs in the case were David Steketee, an FFRF member, and FFRF itself. Steketee and FFRF were represented before the Supreme Court by Berkeley Law School Dean Erwin Chemerinsky, local counsel Paul Grosswald and FFRF attorneys Andrew Seidel and Ryan Jayne, who served as co-counsel. Chemerinsky is one of the most cited legal scholars of all time and has argued several cases before the Supreme Court.

“I was elated to see the ruling this morning,” says Steketee. “Whether or not my fellow New Jersey residents agree with the outcome or not, they nevertheless have had their rights protected. I’m deeply honored by the hard work all the lawyers put into this case over the years. The millions of residents throughout New Jersey and I are forever in FFRF’s debt for helping us to stand up for our rights.”

The Freedom From Religion Foundation is a state/church watchdog comprised of mostly nonreligious 31,000 members nationwide, including 600-plus in New Jersey.

For more details about the case, read here.