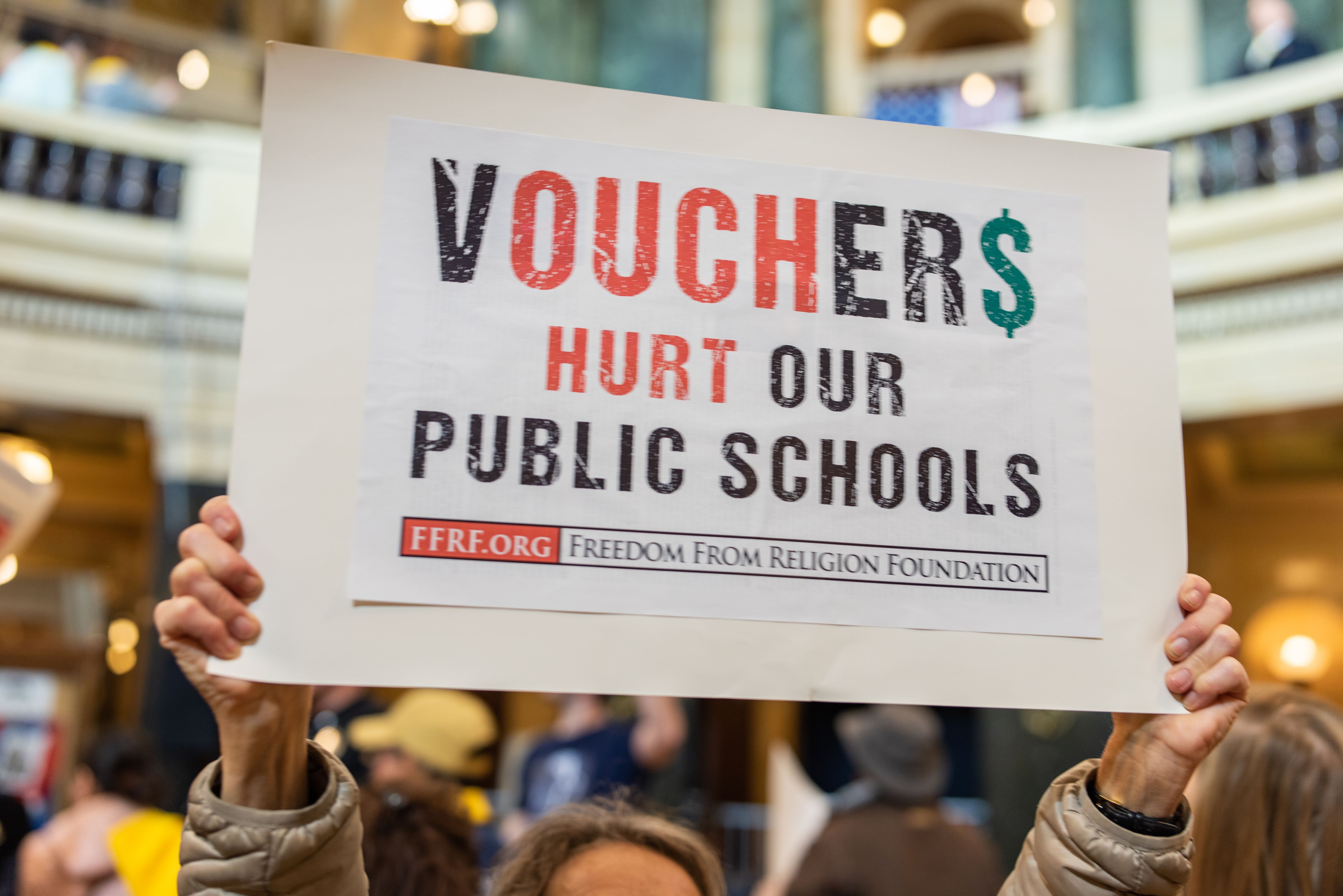

The Freedom From Religion Foundation is urging Congress to include safeguards in the second stimulus bill to thwart public money from being diverted to private school voucher programs.

FFRF has signed on to a joint letter with dozens of like-minded groups (including the NAACP and People For the American Way) asking for language in the HEROES Act that would prevent the creation of private school voucher programs and other similar mechanisms.

The letter warns that voucher schemes are rife with fraud and abuse. Because there’s no governmental oversight of the schools or how the money is allocated, private schools have no accountability to the taxpayers who are subsidizing them.

“Voucher programs have proven ineffective in improving students’ academic achievement, lack accountability, and fail to provide students with the rights and protections they would receive in public schools,” the letter states. “Funneling federal dollars to private and unaccountable education providers in a time of hardship for schools, educators, students, and families across the county is especially bad policy.”

FFRF has long warned of the dangers of school vouchers and has done yeoman’s work in exposing their drawbacks.

“Vouchers going to religiously segregated schools are proven failures,” says FFRF Co-President Dan Barker. “Congress needs to ensure that no further taxpayer money is wasted on such schemes.”

The letter also opposes the addition of any other provision that would channel public dollars to private schools or create tax incentives for private school expenditures. Some members of Congress have shown support for a proposal that would expand the use of 529 education accounts to cover “qualifying expenses incurred in connection with learning from home.” A proposal like this would end up giving wealthy families a tax break, the letter points out, since only 3 percent of American families utilize Coverdell or 529 accounts (according to a 2012 GAO report). The expansion of 529 accounts could also perpetuate racial inequities in education, since minority families are less likely to participate in such plans.

“In addition, we urge you to reject proposals that would provide both temporary and long-term tax policy changes to incentivize parents to educate their children in private schools,” the letter states. “Specifically, we oppose changes to tax credits and deductions, such as allowing private school tuition to be considered the same as philanthropic aid, which would predominantly benefit the 70 percent of families with a household income above $75,000 who educate their children in private schools.”

The letter urges Congress to do its utmost to stop the public financing of private school vouchers almost exclusively benefiting religious schools in a package meant to provide economic relief to the American people.

“This unprecedented pandemic should not be exploited to promote unaccountable, inequitable, and ineffective private school vouchers or otherwise divert public funding for private schools,” the letter concludes.