The Freedom From Religion Foundation will be defending its housing allowance victory before the 7th U.S. Circuit Court of Appeals on Wednesday, Oct. 24. FFRF’s momentous challenge to preferential tax allowances given to “ministers of the gospel” could shake up the federal tax structure.

Treasury Secretary Steven Mnuchin and several churches appealed a ruling last year by U.S. District Court Judge Barbara Crabb that found unconstitutional an IRS provision that allows housing allowance payments to clergy in tax-free dollars.

At issue is the constitutionality of 26 U.S.C. § 107(2), a provision in the tax code that excludes from gross income housing allowances that are paid to “ministers of the gospel.” The clergy allowance is an outright exemption, not a mere tax deduction, permitting housing allowances paid as part of clergy salary to be subtracted from taxable income. Rep. Peter Mack, sponsor of the 1954 law challenged by FFRF, argued that ministers should be rewarded with a clergy allowance for “carrying on such a courageous fight against this [a godless and anti-religious world movement].”

The case will be argued by litigator Richard L. Bolton and by Arizona State University tax law Professor Adam Chodorow as a friend-of-the-court. Chodorow has written extensively about the unconstitutional preference given to religion by the IRS via the clergy housing allowance. He is the primary author of a snappy friend of the court brief signed by several other tax law experts contending that the housing allowance is a subsidy for ministers, is not an appropriate accommodation for religion, ignores important differences in ministerial income and entangles church and state. The claim that clergy need to use their homes for their duties are “significantly overstated,” they write, and could equally apply to doctors, police, and corporate employees who are often transferred from office to office. “Yet no one claims that these employees should get tax-free housing.”

The benefit of the tax exemption to the clergy is enormous. The congressional Joint Committee on Taxation has reported that the exemption amounts to $700 million a year in lost revenue. Religion News Service calculated the allowance increases the take-home pay of some pastors by up to 10 percent.

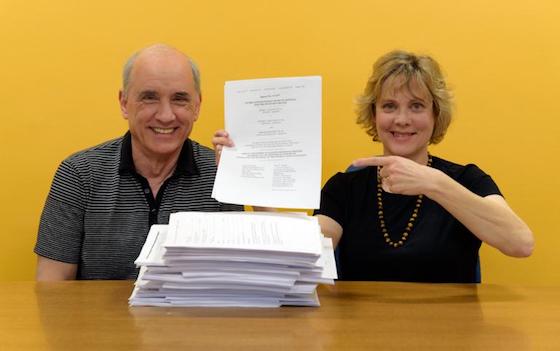

This is the second time that a challenge to the clergy housing allowance will be heard before the 7th Circuit. After FFRF won a similar challenge in district court in 2013, the 7th Circuit determined that plaintiffs Dan Barker and Annie Laurie Gaylor, co-presidents of FFRF, did not have standing to challenge the law because they hadn’t yet sought a refund of their housing allowance from the IRS. Accordingly, they sought such a refund and when denied, went back to court. The court is now primed to rule on the merits of the case. The pair assert they are similarly situated to clergy as heads of a nontheistic group and that being denied the same benefits is discriminatory and clearly shows favoritism for religion.

“Although defendants try to characterize § 107(2) as an effort by Congress to treat ministers fairly and avoid religious entanglement, the plain language of the statute, its legislative history and its operation in practice all demonstrate a preference for ministers over secular employees,” wrote Judge Crabb, for the Western District of Wisconsin, when she decided in favor of FFRF.

“The clergy and churches have become accustomed to privileges and prerogatives from our secular government that are not only unconstitutional but also don’t play fair,” says Gaylor. “The rest of us shouldn’t have to pay more taxes because clergy don’t pay their fair share.”