V(ouch!)ers hurt our public schools and raid taxpayer coffers

Voucher programs, including tuition tax credit schemes, run counter to these founding principles of the United States:

- Public schools. A cornerstone of America is our “common school” — free, publicly supported schools open to all children regardless of social class, religion, ethnicity, gender or country of origin. America forged the very concept of universal education.

- Governmental accountability. Where public money goes, public accountability should follow.

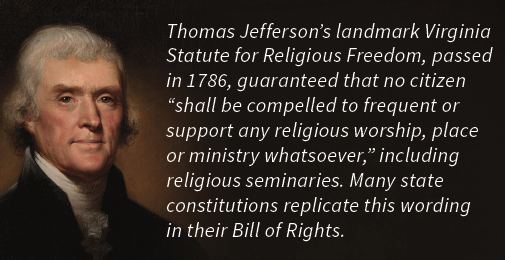

- Separation between church and state. Our country was founded in part by refugees seeking a place where government could not dictate which church or church school they must attend or support. In successfully defeating a Virginia proposal to subsidize religious education, James Madison opposed even “three pence” in such support, advising, “It is proper to take alarm at the first experiment on our liberties.” 1

Many Americans are alarmed at proposals to defund public schools, where 90 percent of students are enrolled. Proponents of vouchers, in openly seeking to “privatize” education, are attacking treasured American principles. The dozens of voucher programs in 31 states (as of spring 2023) divert ever more taxpayer funds from public schools. Yet voucher schools remain free to exclude students, disregard regulations, provide little accountability and indoctrinate students at public expense.

Vouchers funnel money to religious schools

The vast majority of private schools are religiously affiliated. Vouchers and tuition tax credits almost

entirely benefit religious schools with overtly religious missions, which integrate religion into every

subject.

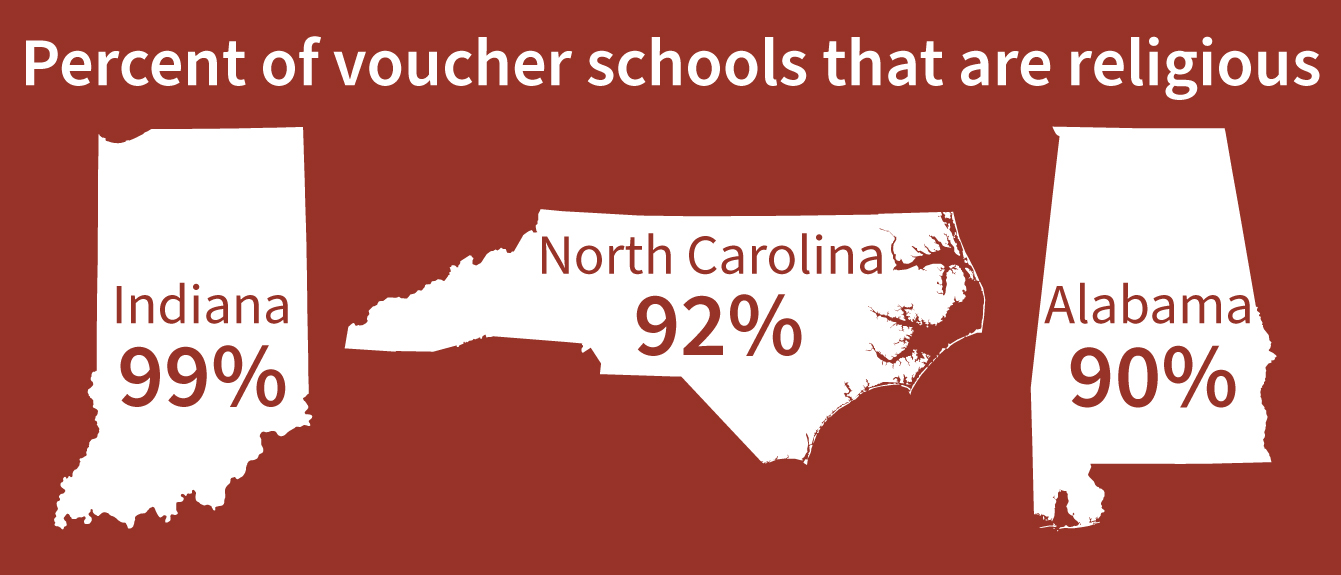

- In Alabama, even as enrollment numbers fluctuated, the percentage of vouchers going to religious schools stayed around 90 percent. 2

- In Indiana, 99 percent of the schools participating in the school voucher program are religious schools.3 In a 2016 survey by the Friedman Foundation, the number one reason cited by parents for choosing a voucher school was due to its religious environment/instruction.4

- In North Carolina, 92 percent of students receiving public money through opportunity scholarships attend religious schools.5

- In 2015, the Colorado Supreme Court wisely struck down a state voucher program that allowed parents in a suburban school district to use tax dollars to send children to private schools, ruling “a school district may not aid religious schools.”6

Vouchers lack accountability

The lack of oversight of voucher schools encourages widespread fraud and mismanagement. Taxpayers cut the checks to voucher schools, yet have no say in how they are run. Public schools are managed under democratically elected school boards that assert public oversight. Citizens have no means to review voucher school records, attend meetings, or otherwise gather information about school operations or provide input.

- The voucher program in Milwaukee, which is the longest-running in the country, stands as a prime example. More than $139 million in tax money over a 10-year period has gone to Milwaukee voucher schools that were eventually removed from the program for failure to meet requirements related to finances, accreditation, student safety and auditing.7

- Florida’s McKay scholarship program has been the subject of widespread fraud by unaccountable schools that reaped millions, while students with disabilities were not provided a bona fide education.8

- Florida schools taking voucher students don’t have to be accredited and teachers don’t have to be certified.9

- Voucher schools have minimal testing and reporting requirements. In Milwaukee, voucher schools operated for decades without taking statewide tests. Once testing began in 2011, results showed that public school students outperformed voucher students.10 Public schools, while often being defamed as failing by voucher advocates, have been held to far higher standards than voucher schools.

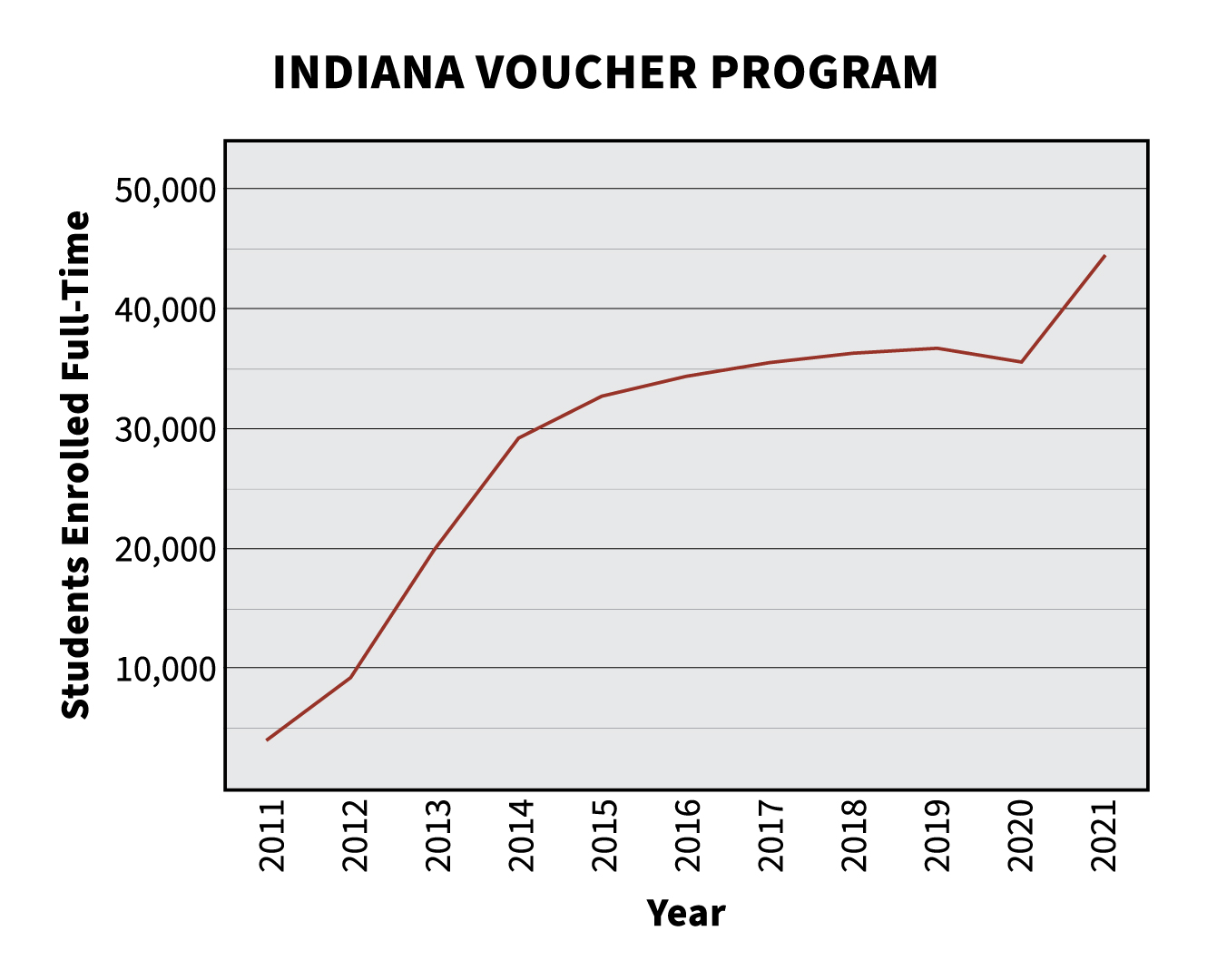

- Recent research reveals “private school vouchers may harm students who receive them.” A study of the Indiana voucher program11 found no improvement in reading scores and “significant losses” in math. A study of Louisiana’s voucher program12 also found negative results in reading and math for voucher students. The Thomas B. Fordham Institute, a pro-voucher think tank, published a June 2015 study of the Ohio voucher program finding: “Students who use vouchers to attend private schools have fared worse academically.”13

Taxpayers cannot afford to pay for a dual-education system

Vouchers increase taxpayer costs. School voucher schemes take money from our public school system and funnel it to private schools.

- Once voucher programs are in place, politicians have changed the rules to allow for rapid voucher expansion. For example, Iowa and Utah recently enacted “universal” voucher programs, allowing parents, regardless of income level, to take state money that would go to local public schools and instead use it for a private religious education.14

- Vouchers have turned self-sufficient churches into publicly subsidized institutions. A study of Catholic parishes in Milwaukee highlights the problem. According to a 2017 study by Daniel Hungerman of the University of Notre Dame, “The typical parish accepting vouchers received more money through that avenue than from offertory donations.”15

Vouchers aren’t about ‘choice’ or ‘civil rights’

The voucher movement is not truly championing “choice” or lifting up disadvantaged students or students of color. It is using disadvantaged youth as pawns in a cynical ploy to divert funds from public schools to private, mostly religious schools. Current federal proposals even call for raiding Title I funds intended for support of low-income students to give to private schools.

- Polly Williams, a Democratic African-American lawmaker in the Wisconsin Legislature, worked with conservatives to inaugurate Wisconsin’s Milwaukee voucher program in 1990. Vouchers were sold to her as a way so low-income and minority children in Milwaukee could attend private secular schools via the “Milwaukee Parental Choice Program.” The Bradley Foundation, a voucher partner, soon lobbied to expand the program to include religious schools. The overwhelming number of students now attend religious schools and many are not needy. Williams charged in 2013: “They have hijacked the program.”16

- Wisconsin voucher advocate George Mitchell callously revealed his agenda when he dismissed Williams as “useful to the school choice movement because of her race and her party affiliation.”17

- In practice, vouchers do not remove students from struggling public schools. Vouchers often replace privately funded education. When statewide vouchers were implemented in Wisconsin, 75 percent of voucher recipients had already attended a private school.18

- Vouchers and tax credits create rural versus urban inequities, since only 20 percent of rural school districts have more than one elementary school and only 7 percent have more than one high school.19

How do unregulated voucher schools operate?

Because private schools receiving vouchers are not subject to the safeguards required for public

Because private schools receiving vouchers are not subject to the safeguards required for public

schools, abuses are rife. Examples include:

- Setting up shop in office and industrial buildings that lack a safe place for students to play outside.20

- Serving students in a Milwaukee voucher school ramen noodles with hot sauce and a cup of water for lunch before the school was removed from the National School Lunch Program.21

Failing to provide textbooks to students.22

Failing to provide textbooks to students.22- Adopting “science” curriculum that claims to refute “the man-made idea of evolution.”

- Teaching a fundamentalist curriculum, such as A Beka Books materials, which have a revisionist historical view of the United States. One text notoriously said, “The majority of slaveholders treated their slaves well.”23

Tuition tax credit vouchers exacerbate abuses

The situation in Arizona, which has one of the oldest, largest tuition tax credit voucher programs, is a cautionary tale, where students receiving them increased from 50,000 in 2005 to 256,000 in 2017. A recent study of Louisiana’s tax credit program described it as a ‘charitable facade’ for the rich, with 99 percent of the vouchers going to families that earn more than $200,000 per year.24

The New York Times has chronicled the shocking way Steve Yarbrough — who as president of the Arizona State Senate promoted the tuition tax credit system — has personally profited. “The fact that an

influential politician can both promote and profit from tax credit vouchers shows what can happen

when public funding for education is largely removed from public hands,” writes Kevin Carey,25 director of education research at the New America Foundation.

Tuition tax credits:

- Permit even less public scrutiny. Direct funding of vouchers is often subject to budget debate or limitations. “The shell-game process of moving money from the public treasury to a donor to a nonprofit to a family to a private school makes it very difficult to account for how well those public dollars are ultimately spent,” Carey notes.26

- Circumvent strict state constitutional prohibitions against public subsidy of places of worship and religious schools.

- Allow private schools benefiting from credits to avoid governmental regulations that may be imposed on direct voucher schools, such as teacher licensing, state audits, test score comparisons, etc.

- Divert millions of dollars from education to bureaucracy, such as the “10 percent” rule in Arizona for overhead.

- Encourage “self-dealing” abuse, wherein parents finance vouchers for neighbors, who reciprocate (a practice outlawed in Arizona, but once widespread).

- Encourage private schools to raise tuition to take advantage of new funding.

- Permit taxpayer subsidy of well-to-do students, such as occurs in Arizona and Louisiana (varying by state).

- Permit taxpayer subsidy of education deviating from accepted academic standards. Among tax credit recipients is Northwest Christian School, with 1,500 students in Phoenix, whose science and social studies curricula were developed by Bob Jones Publishers, a major promoter of creationism.

Already 21 states offer some type of scholarship tax credit.27 Other schemes include direct public tax credits or deductions for families with a child attending a private school, education savings accounts (ESAs) that may be used to pay for private or religious school tuition, or even making all ESA gains free from federal taxation. ESAs place taxpayer funds into private savings accounts that can be used for private school tuition or other qualifying expenses, which vary from state to state but are both costly and susceptible to abuse.

Protecting states’ rights

Decisions on education funding and policy have traditionally been left to state and local governments. The pending federal voucher bills would involve massive federal interference in state and local governments. Many state constitutions wisely prohibit the state from providing aid to religious schools. Federal voucher legislation must not infringe on these state constitutional protections.

Vouchers subsidize segregation and discrimination

Our public school system is a pluralistic institution where all students are welcome regardless of their background or religion. Voucher schools are heavily segregated on the basis of religion. Voucher schools have few barriers to prevent them from discriminating in hiring or student admissions on the basis of religion, sexual orientation or disability. In contrast, public schools must provide a free and appropriate education to all students, including those with disabilities.

“They can discriminate based on religion, or disability or language needs,” notes Lily Eskelsen Garcia,

president of the National Education Association. “That is the exact antithesis of a public school.”28

Vouchers mix church and state, and hurt both

Voucher schemes are a backdoor means of funding religious schools with taxpayer money, undermining the principle of separation of state and church. They benefit those denominations that have the

most private school infrastructure in place.

Congress and states should reject vouchers and tuition tax credits and protect public education, heeding the wise words of the father of the U.S. Constitution, James Madison, who noted: “Religion and government will both exist in greater purity, the less they are mixed together.”29

View citations at: ffrf.org/vouchercitations

FFRF | P.O. Box 750 | Madison, WI 53701

FFRF.org | 608/256–8900