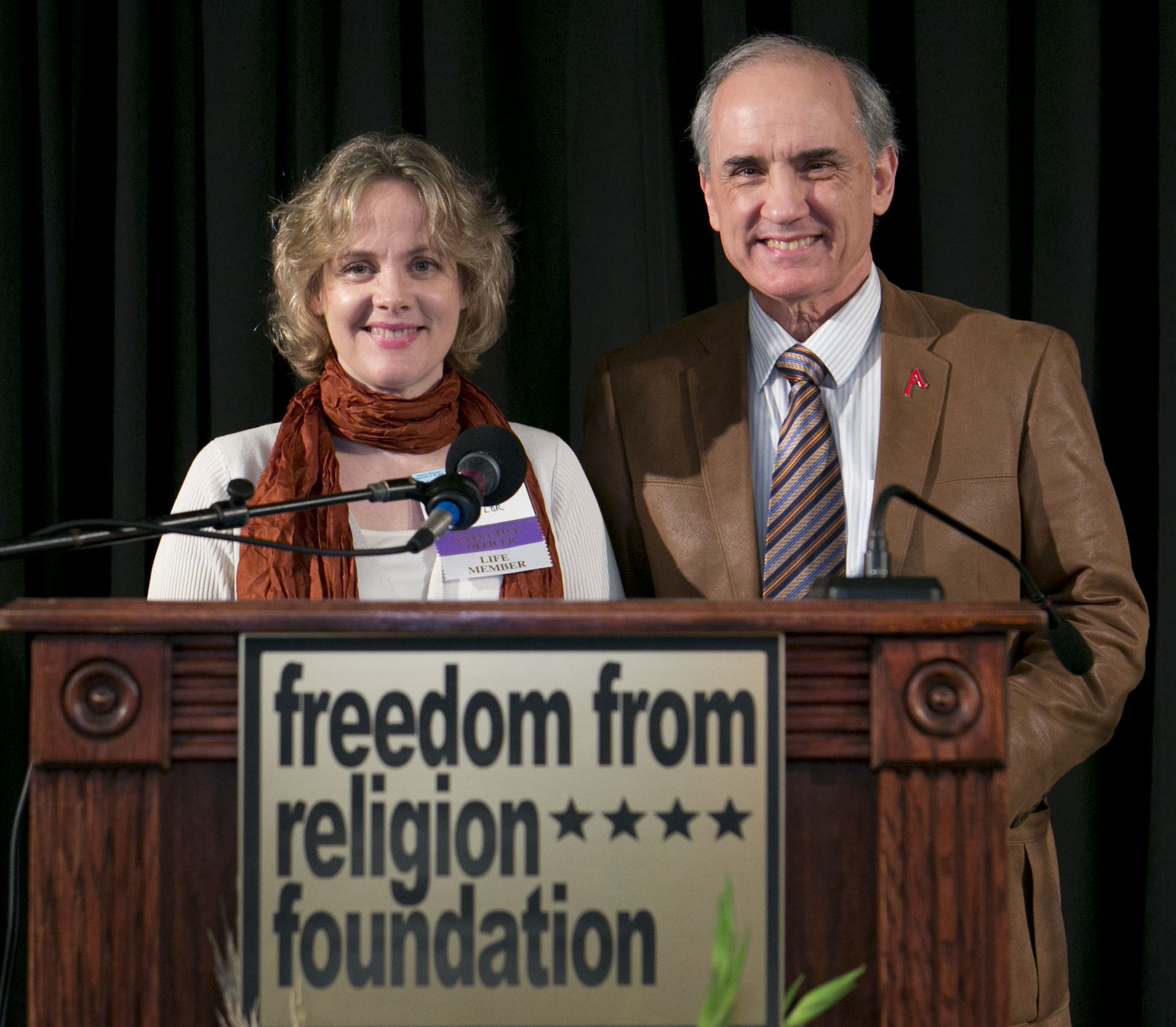

Freedom From Religion Foundation Co-Presidents Dan Barker and Annie Laurie Gaylor, who learned today a three-judge panel of the 7th U.S. Circuit Court of Appeals says they have no right to challenge the discriminatory "parsonage exemption," expressed disappointment that the court is unwilling to confront "this blatant preference for ministers and churches."

Freedom From Religion Foundation Co-Presidents Dan Barker and Annie Laurie Gaylor, who learned today a three-judge panel of the 7th U.S. Circuit Court of Appeals says they have no right to challenge the discriminatory "parsonage exemption," expressed disappointment that the court is unwilling to confront "this blatant preference for ministers and churches."

The panel, in a unanimous decision by Circuit Judge Joel Flaum, vacated a strong ruling a year ago by U.S. District Judge Barbara B. Crabb for the Western District of Wisconsin, declaring unconstitutional 26 U.S. C. § 107(2), passed by Congress in 1954.

The law allows "ministers of the gospel" paid through a housing allowance to exclude that allowance from taxable income. Ministers may, for instance, use the untaxed income to purchase a home, and, in a practice known as "double dipping," may then deduct interest paid on the mortgage and property taxes.

"It's important to note," said attorney Richard L. Bolton, who handled the litigation, "that the court's opinion in no way reflects that the housing allowance is constitutional." As Flaum himself noted, the court did "not reach the issue of the constitutionality of the parsonage exemption."

In fact, the court seemed to acknowledge that the law is discriminatory, saying "the mere fact that discrimination is occurring is not enough to establish standing."

FFRF sets aside a portion of the salaries for Barker and Gaylor as a "housing allowance," which, under the IRS code, the couple is not eligible to claim, as they are not "ministers of the gospel," but instead espouse atheism, freethought and secularism.

Gaylor and Barker took issue with the appeals court's cavalier assessment that they have suffered no concrete injury, since they must pay taxes on their housing allowance, while ministers are rewarded, simply for being religious leaders, with a unique and substantial tax benefit. The parish allowance is not a tax deduction but an exemption — housing allowances are subtracted from taxable income.

"We will continue to challenge this indefensible favoritism for religion in other forums until the issue cannot be circumvented," Barker said.

Barker, by the way, is a former minister who was rewarded with this subsidy when he was "Reverend Barker," a believer, and is now penalized as "Mr. Barker," serving as a freethought leader.

Virtually all major denominations and many minor congregations weighed in, with amicus briefs against FFRF's challenge to religious privilege, including Protestant, Catholic Jewish, Unitarian and Muslim.

"This privilege which religion and its leaders demand is discriminatory, and clearly signals governmental preference and subsidy for the promulgation of religion over nonreligion," Gaylor charged.